Ever wonder why approximately 72% of Black people have bad credit scores? The answer lies in a painful history of systemic racism and discrimination that has denied Black bodies access to financial opportunities and has led to what is now referred to as financial redlining.

Financial redlining refers to the discriminatory practice of denying individuals and communities of color access to credit and other financial services based on their race or geographic location. This practice, which has roots in the 1930s and 1940s, has resulted in Black Americans having limited access to credit, which in turn has had a lasting impact on their credit scores.

In recent years, studies have shown that Black Americans are more likely to be denied loans, pay higher interest rates, and be targeted by predatory lenders. This, combined with factors such as lower income levels and higher levels of debt, has led to a significant disparity in credit scores between Black and white Americans.

This disparity not only affects the ability of Black Americans to secure loans, but it also has a ripple effect on their financial stability and mobility. Poor credit scores can prevent individuals from accessing basic necessities such as housing, transportation, and employment. In a vicious cycle, this lack of access to financial opportunities perpetuates financial hardship and exacerbates the wealth gap between Black and white Americans.

It’s important to acknowledge that the problem of financial redlining is not just a relic of the past, but a continuing reality that Black Americans face today. While there have been some efforts to address Black issues since the George Floyd protests, much more needs to be done to address the root causes of systemic racism and discrimination in the financial sector.

It’s hard to not think of the banality of evil when we reflect over how even the credit score had been made to serve as yet another painful weapon of white supremacy, perpetuating a legacy of discrimination and limiting the financial opportunities of Black Americans.

It’s time for action to be taken to ensure that all individuals, regardless of race, have equal access to financial services and opportunities.

But there's more. Check out these bussin stories:

- Parenting SMH

Is your child becoming far-right? 11 early radicalization signs The calm before the racist storm: reach out for help if you spot two or more of these lesser known warning signs.

Is your child becoming far-right? 11 early radicalization signs The calm before the racist storm: reach out for help if you spot two or more of these lesser known warning signs. - Parenting SMH

If abortion really is murder, do you want to hand a psycho a baby? If she doesn't want, and is prepared to murder a baby, how can you even think of giving a woman like that a baby to take care of?

If abortion really is murder, do you want to hand a psycho a baby? If she doesn't want, and is prepared to murder a baby, how can you even think of giving a woman like that a baby to take care of? - Beauty Health History

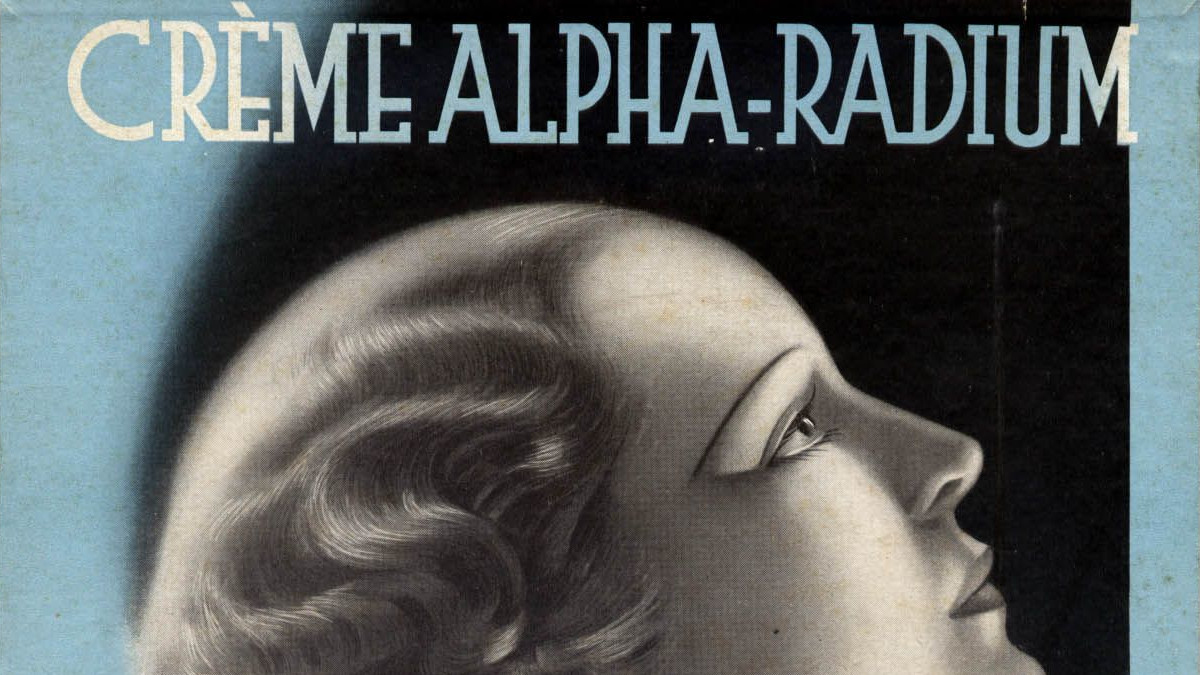

Fatal fashion: the 10 most dangerous fashion trends in history Do you like to go retro? It could cost you your health.

Fatal fashion: the 10 most dangerous fashion trends in history Do you like to go retro? It could cost you your health.

I know it to be true because my people credit score always lower than a white credit score. Like wtf up with that?

Why is it “White people” and “black bodies”? Are black people simply bodies without souls and not people? This is bizarre. The entire premise of the article is completely absurd. No one is preventing any black person from increasing their credit score. Give me a break. One last thing, you forget to capitalize “White” when referring to White people throughout your article.

Credit scores SHOULD be abolished. It’s a favorite weapon of the synagogue of satan. Boomers didn’t have to put up with that bullshit when building their wealth in the 70s and early 80s. It’s a foundation for Social Credit Scores. There’s no actual honor or fairness to it either; companies can gouge your score over the littlest things, but aren’t required to report anything positive to increase your score.